Payment Gateways for Shopify: Ensuring Secure E-Commerce Transactions

Welcome to the world of e-commerce, where the heartbeat of your business lies in the virtual realm. If you’re a proud owner of a Shopify store, you’re no stranger to the significance of secure transactions. In this digital age, where convenience meets caution, providing a seamless and secure payment experience to your customers is paramount. And what’s the unsung hero behind the scenes? Payment gateways. They’re the guardians of your virtual cash register, the digital gatekeepers to secure transactions.

In this guide, we’ll unravel the fascinating world of payment gateways for your Shopify store, exploring their role in ensuring that your customers’ transactions are not only secure but also hassle-free. From the importance of these gateways to considerations for selecting the right one for your business, we’ll take you on a journey through the ins and outs of this essential e-commerce tool. So, fasten your seatbelts and prepare to dive into the world of Shopify payment gateways, where secure transactions are the name of the game.

Introduction to Payment Gateways for Shopify

As an eCommerce business owner utlilizing Shopify, you consider the importance of secure transactions and providing a seamless payment experience to your customers. This is where payment gateways come in.

Overview of Payment Gateways and their importance for secure transactions

Payment gateways are online services that help the processing of payments made through credit or debit cards on your website or online store. They act as a bridge between your website and the financial institutions that handle the actual transaction.

Using a payment gateway for Shopify offers several benefits, including:

- Security: Payment gateways employ various security measures like encryption and tokenization to protect customers’ sensitive payment information. These features minimize the risk of fraud and ensure secure transactions.

- Convenience: Payment gateways provide a hassle-free payment experience for customers by enabling them to make payments conveniently using their preferred payment methods.

- Global Reach: By integrating a payment gateway with Shopify, you can expand your business globally and cater to customers from different countries. Payment gateways support multi-currency transactions and facilitate seamless international payments.

- Reliability: Payment gateways are reliable and efficient platforms that ensure fast and accurate payment processing. They have robust infrastructure and systems in place to handle high volumes of transactions without downtime or errors.

What are the Considerations for Choosing a Payment Gateway for Shopify?

When considering a payment gateway for your Shopify store, keep the following aspects in mind:

Supported Payment Methods:

Check if the payment gateway supports numerous payment methods, including major credit cards, debit cards, and popular digital wallets. The more options available, the better it is for your customers.

Transaction charges:

Compare the transaction fees charged by different payment gateways. Some gateways have a flat fee per transaction, while others may have a percentage-based fee. Consider your business volume and choose a cost-effective solution.

Security Measures:

Prioritize security features like SSL encryption, tokenization, and fraud prevention tools offered by the payment gateway. Ensure that the gateway is compliant with industry standards to protect your customers’ data.

What are the top-rated Payment Gateways for Shopify?

1. Shopify Payments

Shopify Payments is undoubtedly a standout choice when it comes to handling payments for your online store. Owned by the renowned e-commerce platform Shopify, it offers a comprehensive solution for managing costs without the hassle of third-party services.

One of the significant advantages of Shopify Payments is that it comes bundled with all the essential features you need. This means you can efficiently process payments without the need for additional third-party tools or services. It’s an all-in-one package that simplifies the payment process for both store owners and customers.

Pros of shopify payments

- Free Card Reader:

For those with physical retail locations, Shopify Payments provides a complimentary card reader, making in-person payments a breeze. This convenient feature can help streamline your business operations.

- Reduced Transaction Fees:

Shopify Payments stands out by exempting you from the standard 2.2% transaction fee that Shopify applies to third-party payment methods. This can significantly lower your operational costs. Plus, if you choose to upgrade your Shopify subscription plan, you can enjoy even lower credit card transaction fees.

- Security Features:

Shopify Payments places a strong emphasis on security, ensuring that your transactions are safe and protected. Your customers can make purchases with confidence, knowing their data is secure.

- Quick Checkout Process:

The checkout process is swift and efficient, minimizing cart abandonment rates and ensuring a smooth shopping journey for your customers.

Cons of shopify payout

On the flip side, it’s important to note a couple of drawbacks:

- Limited Availability:

Shopify Payments is not available in all countries. This means that if your business operates in a region where it’s not supported, you’ll need to explore alternative payment solutions.

- Temporary Fund Withholding:

In some cases, Shopify may temporarily withhold your funds. While this is a security measure, it can be frustrating, primarily if you rely on a steady cash flow.

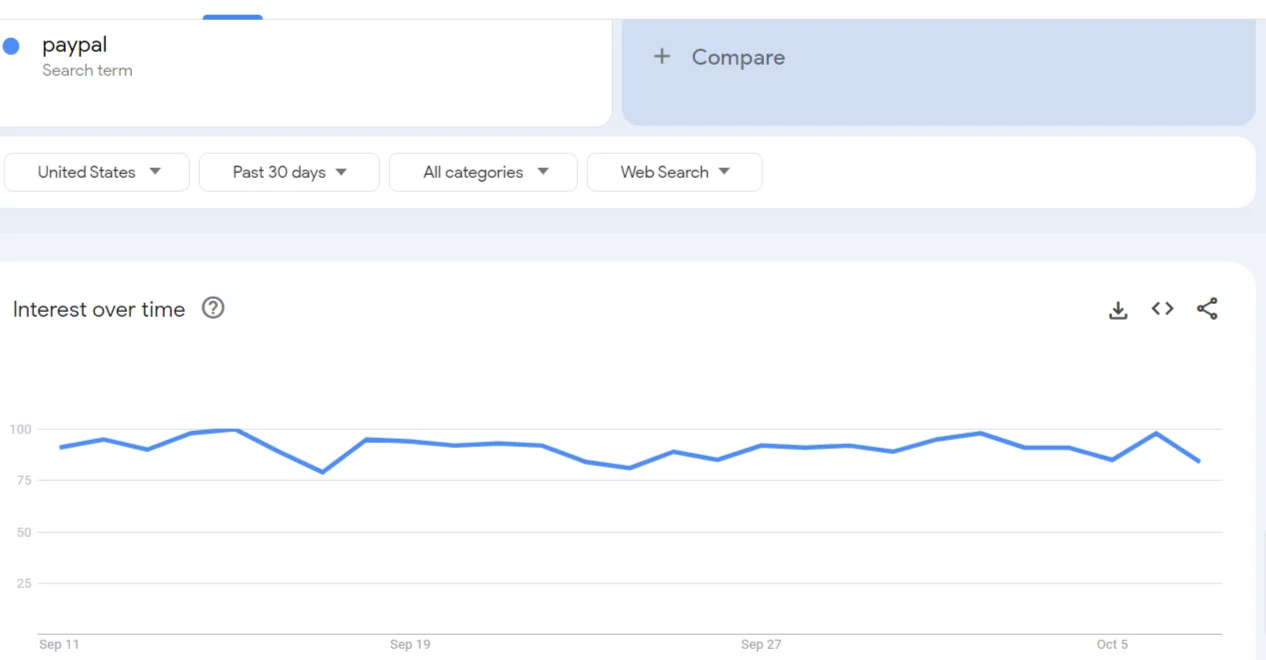

2. PayPal

If you’re looking for a reliable and widely recognized payment gateway for your Shopify store, look no further than PayPal. With over 392 million active accounts worldwide, PayPal is a trusted name in the e-commerce industry. It includes a number of features and benefits specifically tailored for Shopify merchants.

PayPal features and benefits for Shopify merchants

- Seamless customer experience: PayPal enables customers to make purchases using their PayPal account, credit or debit cards, or even their bank account, providing them with a variety of payment options.

- Enhanced security: PayPal is committed to protecting both buyers and sellers with its secure payment infrastructure and fraud detection tools.

- Global reach: With support for over 200 markets and 25 currencies, PayPal allows you to expand your customer base internationally.

- Easy integration: Setting up PayPal as a payment gateway on Shopify is straightforward and can be done in just a few steps.

How to set up PayPal as a Payment Gateway on Shopify

To add PayPal as your preferred payment gateway on Shopify, follow these steps:

- Log in to your Shopify admin panel.

- Go to “Settings” and click on “Payment providers”.

- Scroll down to the “Third-party providers” section and select PAYPAL

- Enter your PayPal email and click on “Activate”.

- Configure the settings according to your specified preferences, such as authorization and capture settings.

- Save your changes, and PayPal will now be available as a payment option for your customers.

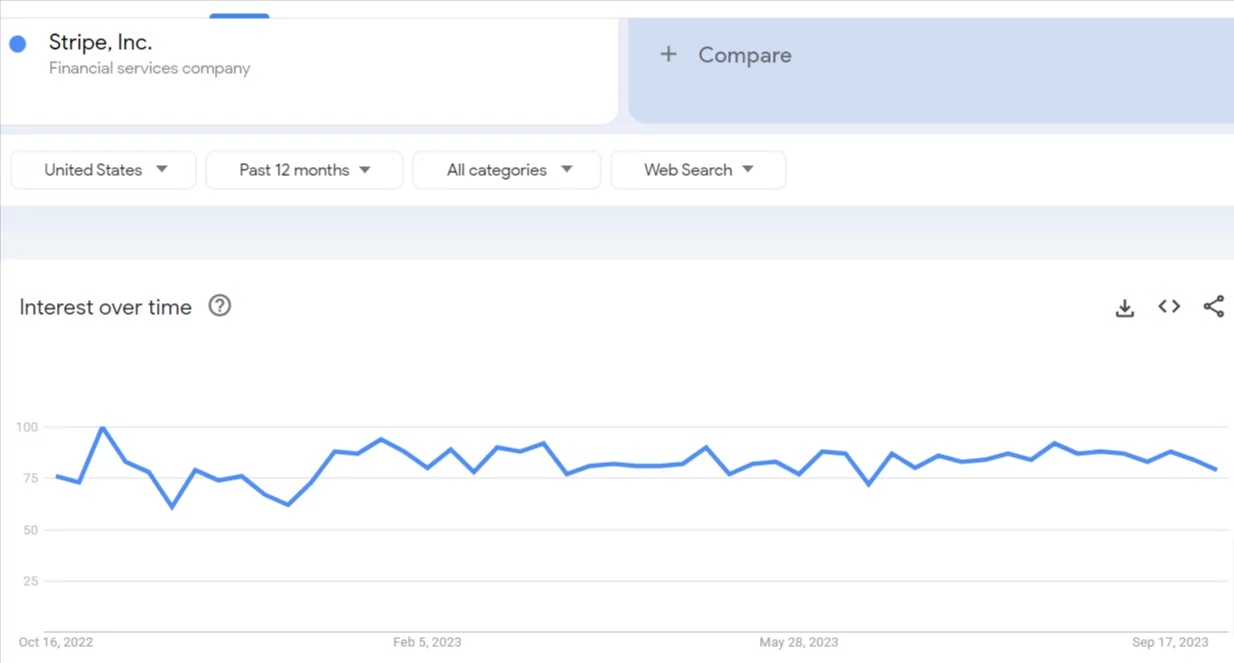

3. Stripe

Another popular choice for a payment gateway on Shopify is Stripe. Trusted by millions of businesses worldwide, Stripe offers a secure and seamless payment experience for both merchants and customers.

Stripe’s advantages and integration options with Shopify

- Customizable payment experience: Stripe allows you to create a tailored payment flow that matches your brand’s look and feel, providing a seamless checkout process.

- Comprehensive features: Stripe offers a variety of advanced features, including support for over 135 currencies, fraud protection, subscription management, and more.

- Developer-friendly: With its robust API and extensive documentation, Stripe makes it easy for the developers to integrate and customize the payment gateway.

- Transparent pricing: Stripe’s pricing is transparent, with no setup fees, monthly fees, or hidden costs.

Step-by-step guide to adding Stripe as a Payment Gateway on Shopify

To setup Stripe as a payment gateway on Shopify, follow these steps:

- Log in to your Shopify admin panel.

- Navigate to “Settings” and select “Payment providers”.

- In the “Third-party providers” section, click on “Choose third-party provider” and select “Stripe”.

- Click on “Activate Stripe” and enter your API keys, which can be obtained from your Stripe account.

- Save your changes, and Stripe will now be available as a payment option for your customers.

Both PayPal and Stripe offer secure and convenient payment solutions for Shopify merchants. Whether you choose PayPal for its wide recognition or Stripe for its customizable options, integrating these payment gateways will enhance the overall shopping experience for your customers while protecting their payment information.

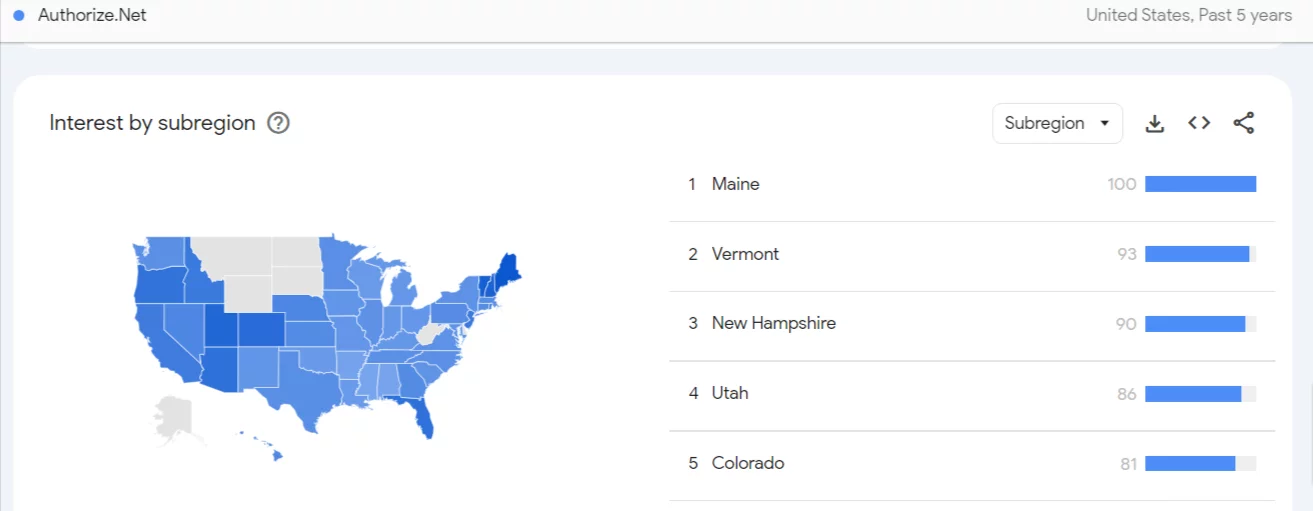

4. Authorize.Net

Authorize.Net is a trusted and widely-used gateway that facilitates secure and reliable payment processing services. It offers a range of features designed to enhance the customer experience and streamline transactions for Shopify merchants.

Authorize.Net’s features and benefits for Shopify merchants

- Secure payment processing: To secure sensitive client information, Authorize.Net employs advanced security methods such as tokenization and encryption.

- Recurring billing: You can use this functionality to set up and manage subscription-based payments.

- Fraud detection and prevention: Authorize.Net includes advanced fraud prevention tools that help minimize chargebacks and protect your business from fraudulent transactions.

- Integration with other systems: Authorize.Net can be easily integrated with various business systems and shopping carts, including Shopify.

Integrating Authorize.Net with Shopify: A comprehensive guide

To integrate Authorize.Net with your Shopify store, follow these steps:

- Sign up for an Authorize.Net account.

- In your Shopify admin panel, go to the “Settings” tab and select “Payment Providers.”

- Click on “Choose third-party provider” and select “Authorize.Net” from the list.

- Enter your Authorize.Net API login ID and transaction key.

- Save the settings and you’re ready to start accepting payments through Authorize.Net.

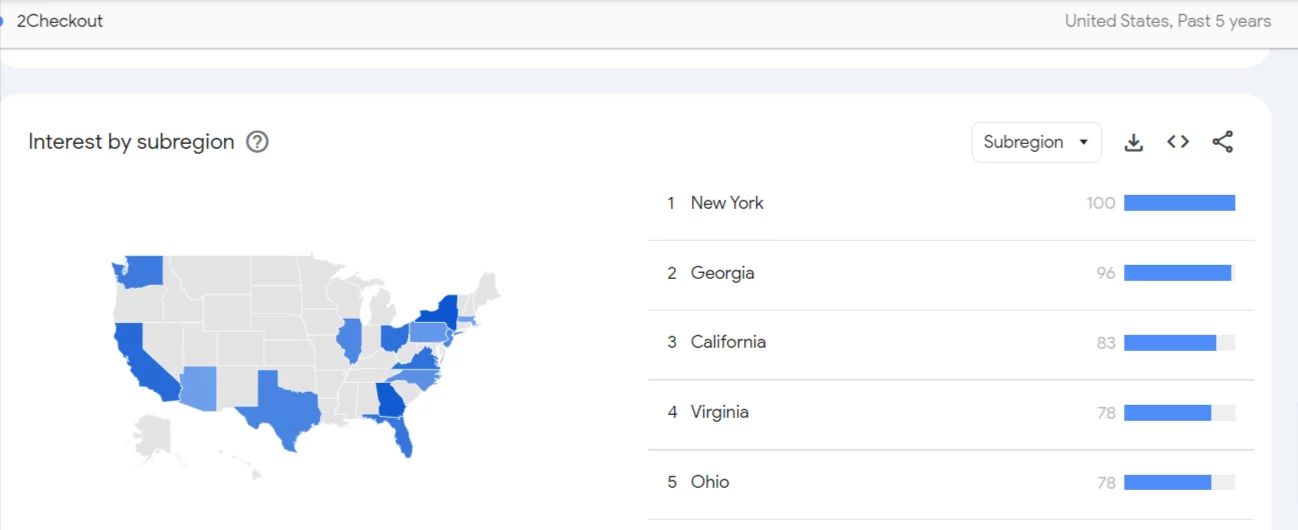

5. 2Checkout

2Checkout is a global payment gateway that enables businesses to accept payments from customers worldwide. It offers a range of features that make it a popular choice for Shopify merchants.

Key features of 2Checkout as a Payment Gateway for Shopify

- International payment acceptance: 2Checkout supports multiple payment methods and currencies, making it ideal for international transactions.

- Subscription management: You can easily set up and manage recurring billing for subscription-based products or services.

- Mobile optimized checkout: 2Checkout provides a responsive checkout experience, ensuring a seamless payment process across different devices.

Setting up 2Checkout on Shopify: A step-by-step process

To integrate 2Checkout with your Shopify store, follow these steps:

- Sign up for a 2Checkout account.

- In your Shopify admin panel, go to the “Settings” tab and select “Payment Providers.”

- Click on “Choose third-party provider” and select “2Checkout” from the list.

- Enter your 2Checkout account number and secret word.

- Save the settings and you’re ready to start accepting payments through 2Checkout.

In conclusion, by exploring alternative payment gateways for your Shopify store such as Authorize.Net and 2Checkout, you can provide secure and seamless transactions for your customers. Whether you’re looking for advanced fraud protection or international payment acceptance, these alternative options can enhance the payment experience for your customers.

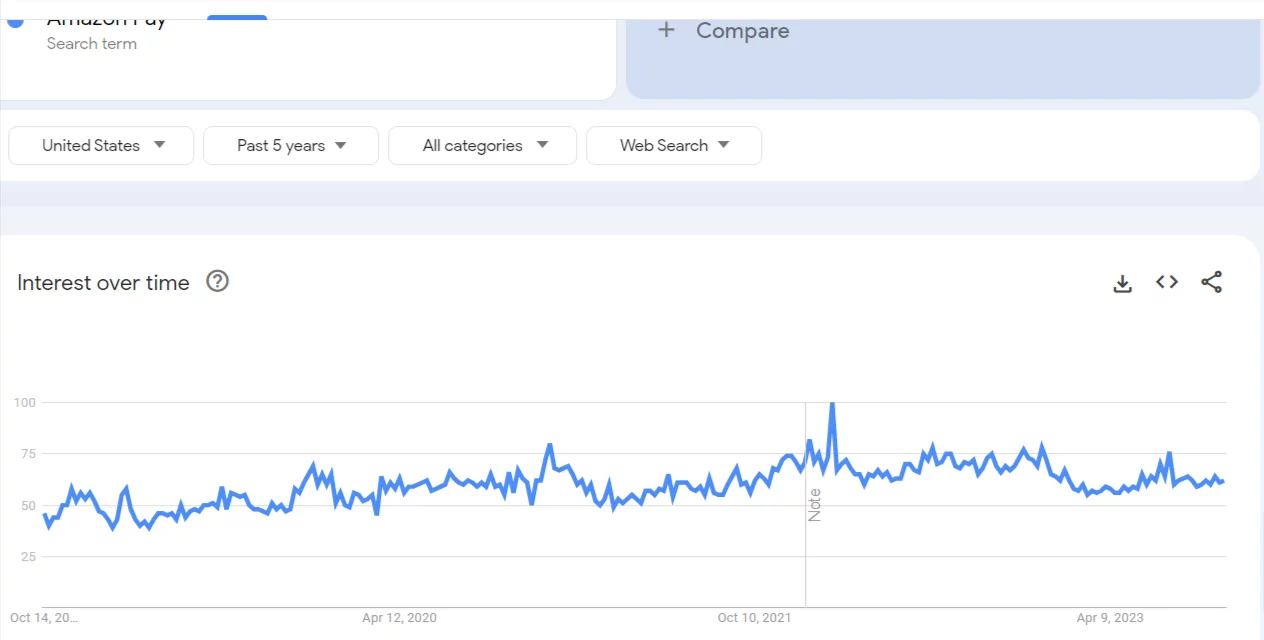

6. Amazon Pay

Amazon Pay is indeed a convenient payment processing gateway for Shopify store owners, and it offers several advantages and some potential drawbacks. Here’s a detailed overview:

Pros:

User-Friendly:

Amazon Pay simplifies the checkout process by allowing customers to use their Amazon accounts. This convenience can lead to high conversion rates as it eliminates the need for customers to manually enter their payment and shipping details.

Global Reach:

Amazon Pay is available worldwide, making it attractive for e-commerce businesses looking to serve a global customer base. It provides a reliable payment method for customers around the world.

Reliable Transactions:

Transactions made with Amazon Pay are typically fast and dependable, which can improve the overall shopping experience for your customers.

Customer Support:

Amazon Pay benefits from Amazon’s robust customer support infrastructure, ensuring that store owners and customers can receive assistance promptly when needed.

Fraud Protection:

Amazon Pay provides access to Amazon’s fraud protection system, offering an additional layer of security for your online transactions and reducing the risk of fraudulent activities.

Cons:

Amazon Account Requirement:

One significant drawback is that customers are required to have an Amazon account to use Amazon Pay. This requirement may deter potential buyers who prefer not to create an Amazon account or are looking for alternative payment methods.

No PayPal Support:

Amazon Pay does not support PayPal payments. If your customer base includes a significant number of PayPal users, you might need to offer additional payment options to accommodate their preferences.

Account Closure Risk:

Amazon Pay has a higher risk of account closure if Amazon suspects that you’re violating their rules or policies. Therefore, it’s crucial to be aware of and adhere to Amazon’s terms and conditions to avoid potential disruptions in your payment processing.

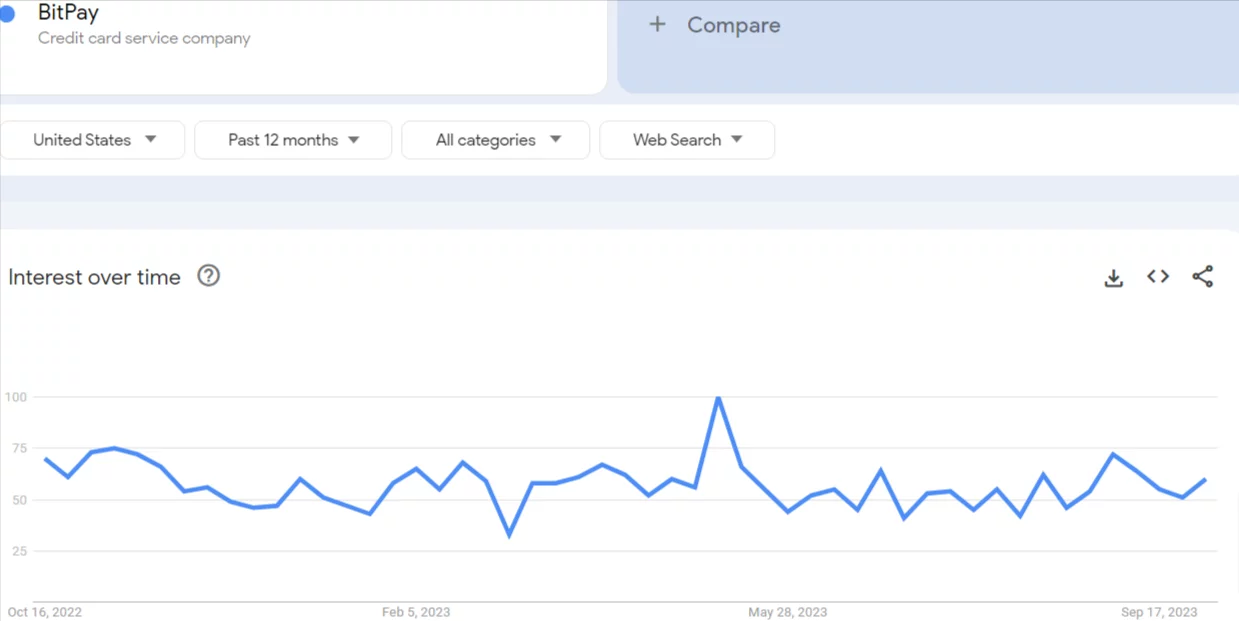

7. BitPay

BitPay is another notable payment processing gateway that can be seamlessly integrated into your Shopify store. Here’s an informative and conversational overview of BitPay as a payment solution. If you’re looking for a payment processing gateway that caters to the world of cryptocurrencies, BitPay is a brilliant choice. BitPay simplifies the process of accepting Bitcoin and other cryptocurrencies as payment on your Shopify store.

Pros:

- Cryptocurrency Acceptance:

BitPay specializes in cryptocurrency payments, making it a valuable option if you want to tap into the growing world of digital currencies. It supports not only Bitcoin but also various other cryptocurrencies, providing flexibility for your customers.

- Global Reach:

Cryptocurrencies are borderless, and BitPay reflects this by enabling international transactions. This can expand your customer base beyond geographical constraints.

- Security:

BitPay is known for its robust security features, which include protection against payment fraud and chargebacks. Cryptocurrency transactions are irreversible, reducing the risk of fraud.

- Quick Settlement:

BitPay offers fast settlement times, often within one business day, allowing you to convert cryptocurrency earnings into your preferred fiat currency swiftly.

Cons:

- Limited Customer Base:

While the adoption of cryptocurrencies is growing, not all customers are familiar with or willing to use digital currencies. This could limit the number of potential buyers who are comfortable with this payment method.

- Fluctuating Value:

Cryptocurrencies are known for their price volatility. If you choose to hold cryptocurrency earnings, you might be exposed to price fluctuations, which could impact your revenue.

- Account Management:

Managing your BitPay account requires compliance with cryptocurrency regulations and thorough record-keeping. This can be somewhat complex and may require additional effort compared to traditional payment methods.

Considerations for selecting the best Payment Gateway for your specific needs

Choosing the correct payment gateway is one of the most important decisions you must make when creating an online business on Shopify. A payment gateway is a service that enables you to process consumer purchases securely on your website. Here are some factors to think about while deciding on the appropriate payment gateway for your requirements:

- Security: Security should be a top priority when it comes to handling customer payments. Look for a payment gateway that is PCI-DSS compliant and offers robust fraud prevention measures such as tokenization and encryption.

- User experience: A seamless checkout experience is essential for customer satisfaction. Choose a payment gateway that provides a smooth and intuitive payment process, with minimal redirects and a mobile-friendly interface.

- Supported countries and currencies: Consider your target market and make sure the payment gateway supports the countries and currencies you’ll be dealing with. Some gateways have limited international coverage, so it’s important to check their supported regions.

- Integration: Check if the payment gateway integrates seamlessly with Shopify. Ideally, you’ll want a gateway that offers a pre-built integration or a dedicated Shopify app for easy setup and management.

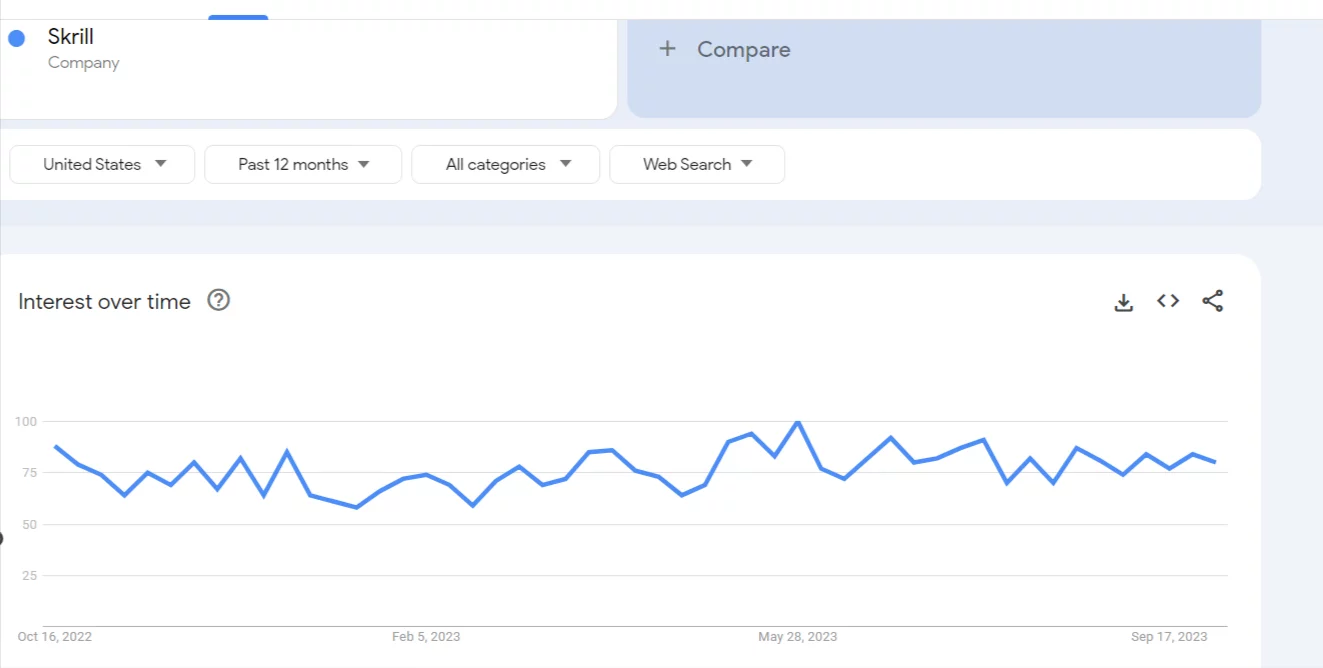

8. Skrill

Were you looking to expand your e-commerce business on a global scale? Skrill is a payment processing solution that can simplify international transactions for your Shopify store. Here’s a concise introduction to Skrill:

Pros:

- International Reach: Skrill is a recognized and trusted name in online payments, providing access to a vast international customer base. It’s an ideal choice if you aim to serve customers from around the world.

- Security: Security is a top priority for Skrill. The platform offers robust features, including two-factor authentication and anti-fraud measures, to protect your business and your customers’ sensitive data.

- Quick Transfers: Skrill facilitates swift fund transfers, ensuring that you can access your earnings promptly and reduce the waiting time for your customers.

Cons:

- Service Fees: Skrill applies various fees, such as transaction fees, currency conversion fees, and withdrawal fees. These costs can accumulate and impact your overall profitability, so it’s important to factor them into your financial planning.

- Limited Cryptocurrency Support: While Skrill does offer cryptocurrency services, its cryptocurrency support is limited compared to specialized platforms like BitPay. If you intend to focus on cryptocurrency payments, other options might be more suitable.

- Account Verification: Skrill may require thorough account verification procedures, which can be somewhat time-consuming and may be a hurdle for some users.

9. Coinbase

Coinbase can be linked with Shopify as a payment option to accept cryptocurrency payments for your e-commerce store. Here’s how it connects with Shopify payments:

Pros for Using Coinbase with Shopify:

- Diversified Payment Options: By integrating Coinbase with your Shopify store, you provide customers with an additional payment method.

- Global Reach: Cryptocurrencies are borderless, and Coinbase’s integration allows you to cater to an international customer base. This can be advantageous if your e-commerce business targets a worldwide audience.

- Security: Coinbase places a strong emphasis on security, which aligns with Shopify’s commitment to safeguarding customer data. This ensures a secure environment for both your business and your customers.

Cons for Using Coinbase with Shopify:

- Fees: Coinbase, like most cryptocurrency exchanges, charges fees for transactions. These charges can vary based on the specific services and payment methods you use. Integrating Coinbase may add a layer of fees on top of Shopify’s standard transaction charges.

- Limited Control: While Coinbase is user-friendly, it might not provide the level of control and advanced features that some experienced cryptocurrency users or businesses may require. Advanced traders may prefer dedicated cryptocurrency exchanges.

- Regulatory Compliance: When integrating Coinbase with Shopify, it’s essential to be aware of and adhere to any regulatory guidelines regarding cryptocurrency transactions. Coinbase’s compliance requirements may necessitate identity verification and due diligence, which can be an extra step for users.

Enhancing Security with Payment Gateways on Shopify

Best practices for ensuring secure transactions on your Shopify store

When it comes to running an online business, one of the most critical aspects is ensuring the security of your customers’ transactions. By integrating reliable payment gateways on your Shopify store, you can provide a secure and seamless checkout experience. Here are some best practices to enhance transaction security on your Shopify store:

- Choose a reputable payment gateway: It is crucial to finialize a trusted and reliable payment gateway provider to process your customers’ transactions. Popular options such as PayPal, Stripe, and Authorize.net are well-known for their excellent security measures.

- Enable SSL encryption: Secure Socket Layer (SSL) encryption is essential for protecting sensitive customer information during online transactions. Make sure your Shopify store has an SSL certificate installed to encrypt data and provide a secure browsing experience.

- Implement two-factor authentication: Two-factor authentication allows an additional security, including various apps and plugins that can help you enable this feature.

- Stay up-to-date with security patches: Regularly update your Shopify store and its plugins to ensure you have the latest security patches installed.

Tips for improving customer trust and minimizing fraud risks

Here are some tips to improve customer trust and minimize fraud risks:

- Display trust badges: Showing trust badges, such as SSL certificates and secure payment icons, on your Shopify store’s checkout page can reassure customers that their information is safe and secure.

- Offer multiple payment options: Providing a wide range of payment options can increase customer trust and improve their overall shopping experience. Consider integrating multiple payment gateways to cater to different customer preferences.

- Implement a robust fraud detection system: Fraudulent transactions can be detrimental to your business. Utilize fraud detection tools and services to identify and prevent suspicious transactions, protecting both your customers and your bottom line.

- Display customer testimonials and reviews: Positive testimonials and reviews can facilitate building trust and credibility for your brand. Displaying these on your Shopify store can encourage potential customers to trust and make a purchase.

- Provide transparent refund and return policies: Clearly communicate your refund and return policies to customers. Being transparent about these policies can increase trust and help minimize potential disputes or chargebacks.

Steps for Collecting Payments from Sales on Your Shopify Store

Here’s a concise guide on how to do it:

- Set Up a Payment Gateway:

- Start by choosing a payment gateway that suits your business. Shopify supports various options, including Shopify Payments, PayPal, Stripe, and more.

- Navigate to your Shopify admin dashboard, select “Settings,” and select “Payments.”

- Choose your preferred payment gateway.

- Enter Banking Information:

- To receive payments, you’ll need to enter your banking details.

- Make sure the information is accurate to avoid payment delays.

- Complete Orders:

- When consumers purchase on your Shopify store, they’ll enter their payment information during checkout.

- Shopify securely processes these payments through the selected payment gateway.

- Payment Processing:

- After a successful transaction, Shopify will transfer funds from the customer’s account to your merchant account.

- The payment gateway will handle the transaction securely and may take a few days to process, depending on the gateway and your location.

- Payouts:

- Once the payment is processed, your earnings will be held in your Shopify account until you request a payout.

- You can manually request payouts or set up automatic payouts regularly.

- Requesting Payouts:

- To request a payout, go to your Shopify admin, navigate to “Settings,” and select “Payments.”

- Click on your payment gateway, and you’ll find an option to request a payout.

- Follow the prompts to initiate a fund transfer to your linked bank account.

- Receiving Funds:

- After processing the payout request, the funds will be transferred to your bank account.

- The timing of this transfer can vary based on your payment gateway and location.

- Accounting and Reporting:

- Keep track of your sales, refunds, and payment processing fees using Shopify’s reporting tools.

- You can also integrate accounting software to manage your finances effectively.

It’s essential to review the terms and conditions of your chosen payment gateway to understand their specific policies.

FAQS about Payment Gateways for Shopify

Can I use NayaPay for Shopify?

Yes, you can use NayaPay for Shopify if you are PCI DSS certified, allowing you to integrate it with your website using NayaPay APIs or web plugins for WooCommerce, Magento, or Shopify.

To enable Google Pay on Shopify, what are the requirements?

To enable Google Pay on Shopify, you must use Shopify Payments, adhere to the Google Pay API Terms of Service, and follow the Acceptable Use Policy.

What is the most commonly used online payment gateway in Pakistan?

JazzCash is without a doubt the most commonly used online payment gateway in Pakistan, popular among individual users and small to medium businesses for online transactions.

How can I start receiving payments on my Shopify store?

To start receiving payments on your Shopify store, you need to set up a payment gateway in your store’s settings, enabling you to accept payments from customers.

Why might I not be eligible for payments on Shopify?

You may not be eligible for payments on Shopify due to various reasons, including not completing the required setup, not meeting Shopify Payments eligibility criteria, or issues with your business’s compliance.

Is PayPal better than Stripe for online transactions?

The preference between PayPal and Stripe depends on your specific business needs and location. Both have their advantages, and the choice may vary based on your target audience and requirements.

How do I withdraw funds from my Shopify account?

You can withdraw funds from your Shopify account by setting up a payout method, specifying your banking details, and requesting payouts.

Can I use any bank account with Shopify to receive payments?

You can use a bank account with Shopify for receiving payments, but it’s essential to ensure that your bank is compatible with Shopify Payments and that you have the necessary information to set up the account.

Which is better, PayPal or Payoneer, for international transactions?

The choice between PayPal and Payoneer for international transactions depends on your specific needs. PayPal is widely recognized, while Payoneer offers features tailored for freelancers and businesses.

Is Shopify subject to monthly fees?

Yes, Shopify typically charges monthly subscription fees based on the plan you choose for your online store. Read Shopify Pricing Plans 2023: Which One is Best for Me?

What is the minimum order value for Shopify Payments?

The minimum order value for Shopify Payments can vary, so it’s advisable to review the terms and conditions for your specific region.

How can I avoid fees on Shopify?

To avoid fees on Shopify, you can explore cost-saving strategies, such as choosing payment gateways with lower transaction fees, optimizing your store’s performance, and managing your expenses efficiently.

What is the 20% fee on Shopify?

The 20% fee on Shopify refers to the commission charged for using third-party payment gateways instead of Shopify Payments. It’s essential to understand this cost when choosing payment methods.

How much profit does Shopify take from your sales?

Shopify takes a percentage of your sales, which can vary depending on the payment gateway you use and the specific pricing structure for your Shopify plan.

CONCLUSION

In the world of e-commerce, the role of payment gateways in ensuring secure transactions cannot be overstated. These digital guardians are essential for the seamless and protected flow of funds in your Shopify store.

You have a plethora of options at your disposal, each with its own set of advantages and considerations. Shopify Payments simplifies the process with an all-in-one solution, reducing costs and ensuring swift transactions. PayPal is a global name in e-commerce, offering trustworthiness and recognition. Stripe allows for a tailored payment experience, and Authorize.Net excels in security measures.

For those looking to expand their horizons, 2Checkout simplifies international transactions. Amazon Pay streamlines the checkout process, albeit with some limitations. And for cryptocurrency enthusiasts, BitPay is a gateway to the world of digital currencies.

Skrill facilitates international transactions, while Coinbase caters to crypto-savvy users. Each option offers unique advantages, but it’s crucial to remember that security is paramount, and building trust with your customers is key to minimizing fraud risks.

So, as you navigate the world of e-commerce, remember that your choice of payment gateway can significantly impact the success of your Shopify store. Secure, hassle-free transactions are just a gateway away.

Some other related Topics

- What Is Shopify Dropshipping and How Does It Work?

- How to Dropship on Shopify: Step-by-Step Guide

- Is Dropshipping Profitable?

- Is Shopify Dropshipping Legal?

- Is Dropshipping Worth It?

- How Does Shopify Work: 2023’s Ultimately Guidelines

- How to dropship on Shopify: Easiest Way to Start Overnight[Latest]

What Is Shopify Dropshipping and How Does It Work?

What Is Shopify Dropshipping and How Does It Work?  Shopify Dropshipping: What You Need to Know Before Buying a Business?

Shopify Dropshipping: What You Need to Know Before Buying a Business?  How to Dropship on Shopify: Step-by-Step Guide

How to Dropship on Shopify: Step-by-Step Guide  Getting Paid: Understanding Shopify Payouts

Getting Paid: Understanding Shopify Payouts