“Demystifying Shopify Payouts: How Shopify Pays You”

In the fast-paced realm of e-commerce, Shopify emerges as a beacon of innovation, offering a comprehensive and accessible solution for entrepreneurs and businesses seeking to establish and grow their online presence. This dynamic platform has transformed the complexities of digital retail into a user-friendly, feature-rich experience, making it equally valuable for established enterprises and aspiring startups.

Shopify’s commitment to staying at the forefront of industry trends and emerging technologies empowers merchants to navigate the ever-evolving world of online commerce with confidence and success. As we delve into the intricacies of Shopify payouts, we unveil a critical component that underpins the financial health and growth of digital businesses, making it an essential topic for entrepreneurs to explore.

What is Shopify?

Shopify is a versatile and comprehensive e-commerce platform designed to help individuals and businesses create, operate, and manage online stores. Whether you’re an established enterprise or a budding entrepreneur, Shopify offers a user-friendly, all-in-one solution to kickstart and grow your online business. It provides the tools and resources necessary for setting up an online store, managing inventory, handling payments, and engaging with customers, all within a single platform. For details read What Is Shopify Dropshipping and How Does It Work?

How does Shopify work?

Unified Commerce Platform:

Shopify is an all-in-one solution that unifies various aspects of commerce into a single platform. It allows merchants to create, customize, and manage their online store. Whether you want to sell on the web, on mobile devices, in physical stores, or even through pop-up shops, Shopify has you covered.

Multi-Channel Sales:

With Shopify, you can expand your reach by selling your products or services across multiple channels. This includes not only your online store but also integration with social media platforms and popular online marketplaces, making it easier for potential customers to discover and purchase from your business.

Cloud-Based and Hosted:

Shopify is a cloud-based platform, which means your online store and data are hosted on Shopify’s servers. This eliminates the need for you to manage the technical aspects of hosting and server maintenance. You can access your Shopify store from any compatible device with an internet connection, providing you with flexibility and accessibility.

Ease of Use:

Shopify is user-friendly, with numerous layouts and themes that you can customize to build a visually appealing online store. To get started, you don’t need extensive technical skills.

Integrated Tools:

A successful commerce business requires a variety of tools to manage products, inventory, payments, and shipping. Shopify makes this easier by incorporating these features within its platform. Within the same system, you can quickly manage your product catalog, maintain inventory, and handle payments.

App Integration:

Shopify’s app store offers a diverse range of apps and integrations. As a result, you can quickly expand the functionality of your Shopify site by integrating it with other business tools and services. Accounting software, email marketing, and analytics are just a few examples.

Support and Maintenance:

Shopify takes care of software updates and server maintenance, ensuring that your online store runs smoothly and securely. Read How to Dropship on Shopify: Step-by-Step Guide

What are Shopify Payouts?

Shopify payouts are the process by which Shopify merchants receive their funds from Shopify. When a customer buys from your Shopify store, the payment is processed through Shopify Payments. Once the payment is successfully accepted, Shopify will proceed to deposit the funds into your chosen bank account.

How does Shopify Payouts work?

The frequency of payouts depends on your payout schedule, which you can manage from your Shopify admin settings. Shopify offers a range of options for payout schedules, including daily, weekly, and monthly payouts. The specific payout schedule you choose will determine when funds from customer purchases are deposited into your bank account.

It’s important to note that Shopify may hold funds for a few days before initiating a payout. This is to ensure the security of transactions and protect against potential fraudulent activity. Once the funds are released, they will follow the chosen payout schedule and be deposited into your bank account accordingly.

How Does Shopify Pay You?

Payment methods supported by Shopify

If you are an online business owner using Shopify, you might be wondering how the platform pays you for your sales. Shopify offers various payment methods to its users, ensuring you have options that suit your business needs. The primary payment method supported by Shopify is Shopify Payments. This built-in payment gateway allows you to receive payments directly into your bank account. It is available to merchants in several countries and offers competitive transaction fees.

Guide to Shopify Payouts

For online store owners using Shopify, it is essential to understand how payouts work to ensure a smooth and seamless payment process. Shopify provides a reliable and transparent system for calculating and scheduling payouts to merchants.

How does Shopify calculate and schedule payouts?

When a customer purchases your Shopify store, your sale payment is processed through the Shopify Payments system. The funds from the transaction go through a clearing period, typically lasting around two business days. After this period, the funds are ready for payout.

Shopify then calculates the total payout amount by adding up all the cleared funds from the daily transactions within a specific timeframe. The payout schedule depends on the country where your business is located. In most countries, payouts are typically scheduled every 3-7 days. However, if your store has a high volume of sales, you may be eligible for daily payouts.

Once the payout has been calculated, Shopify automatically transfers the funds to your connected bank account. The time it takes for the funds to reach your account depends on your bank’s processing time.

What are the Factors that may affect payout timing?

Several factors may affect the timing of your payouts. These include:

- Weekends and holidays: Payouts are not processed on weekends or public holidays. In such cases, payouts may be scheduled for the next available business day.

- Bank processing times: The speed at which your bank processes incoming transfers may vary. Some banks may take longer to reflect the funds in your account.

- High-risk industries: If your business falls into a high-risk industry category, such as adult products or CBD, there may be additional scrutiny and potential delays in payouts.

It is important to note that Shopify may hold funds or delay payouts as a security measure to protect against fraudulent activities or chargebacks.

By understanding how Shopify calculates and schedules payouts, as well as the factors that may affect payout timing, you can better manage your cash flow and anticipate when funds will be available for withdrawal.

What are the Shopify Payout Methods?

As an e-commerce business owner, you might be wondering how Shopify pays you for your hard work and sales. In this article, we will demystify Shopify payouts and explain the different methods you can choose from to receive your funds.

Choosing the suitable payout method for your business

When it comes to receiving your payouts from Shopify, it is vital to select the method that suits your business needs. Here are some factors to consider when making your decision:

- Payment Gateways: If you are using a payment gateway integrated with Shopify, you have the option to receive your funds directly to your bank account. This method allows for seamless transactions and quick access to your funds.

- Manual Payouts: If you prefer more control over your payouts, you can choose manual payouts. With this method, you can manually initiate payouts to the linked bank account whenever you choose.

- Currency Options: Depending on your target market and customer base, consider the currency options available for payout methods. Shopify offers multi-currency support, allowing you to receive your funds in your preferred currency.

What are the Options for receiving payouts from Shopify?

Shopify offers different payout options to accommodate different business needs and preferences. Here are the main options available:

- Bank Deposit: This is the most common payout method, where your funds are directly deposited into your chosen bank account.

- Manual Payouts by Check: If you prefer receiving physical checks, Shopify offers the option to receive your funds via mail. Keep in mind that this method may have additional processing and delivery times.

- Alternative Payout Methods: Depending on your region and business setup, you may have access to alternative payout methods such as third-party payment processors or digital wallets.

By understanding the payout methods available and choosing the right one for your business, you can ensure a smooth and efficient process for receiving your funds from Shopify.

Shopify Payout Fees

For anyone running an online store using Shopify, understanding how payouts work and the associated fees is crucial. Shopify offers a seamless payment system that allows you to receive payments from customers and have them deposited into your bank account. Here is a breakdown of the Shopify payout fees and how they compare with other payment providers.

Understanding the fees associated with Shopify payouts

When it comes to receiving payments on Shopify, there are typically two types of fees involved: transaction fees and payout fees.

- Transaction fees: Like other platforms, Shopify charges transaction charges for each sale made through their platform. These fees vary depending on the plan you have chosen and can range from 0.5% to 2% of the transaction amount.

- Payout fees: Shopify also charges a payout fee every time you receive funds from your sales. The price varies based on the currency used for the payout. For example, for USD payouts, the fee is $0.25 per payout, while for other currencies, it may be higher.

Comparing payout fees of different payment providers

When comparing payout fees across different payment providers, it’s essential to consider the overall cost and convenience. While Shopify’s payout fees may seem nominal, it’s essential to compare them with other options to make an informed decision. Here are a few popular payment providers and their typical payout fees:

- PayPal: PayPal platform charges a fee of 2.9% + $0.30 per transaction, with no additional payout fees for receiving funds.

- Stripe: Stripe charges a fee of 2.9% + $0.30 per transaction, with no separate payout fees either.

- Authorize.Net: Authorize.Net charges 2.9% + $0.30 per transaction and has no additional payout fees.

Ultimately, the choice of payment provider and the associated fees will depend on your specific business needs.

How to Manage Payouts in Shopify?

If you’re using Shopify to power your online store, it’s essential to understand how the platform handles payouts. Getting paid promptly and efficiently is crucial for your business’s cash flow. In this article, we will demystify Shopify payouts and guide you through setting up and managing your payout settings.

Setting up and managing payout settings in your Shopify store

Setting up payout settings in your Shopify store is a straightforward process. Here are the steps you need to follow:

- Navigate to your Shopify admin: Log in to your Shopify account and access your admin dashboard.

- Go to the Payment Providers section: In your admin dashboard, go to “Settings” and select “Payment Providers.”

- Select your preferred payout method: Choose from the available payment gateways, such as Shopify Payments, PayPal, or a third-party provider.

- Configure your payout settings: Follow the prompts to set up your chosen payment gateway. Provide the necessary information, such as your bank account details or PayPal email address.

- Review and save your settings: Double-check all the information you’ve entered before saving your payout settings.

Once your payout settings are configured and saved, Shopify will automatically transfer funds to your designated bank account or PayPal account according to your selected payout schedule.

What are the troubleshooting common payout issues?

While Shopify strives to ensure smooth payouts, there may be instances when issues arise. Here are some common payout issues and tips for troubleshooting:

- Delayed or missing payouts: If you notice a delay in receiving your payouts or if any funds are missing, reach out to Shopify’s support team immediately. They will investigate and resolve the issue for you.

- Invalid or incorrect payout information: Make sure you have entered the correct bank account details or PayPal email address. Double-check the news in your payout settings to avoid any payment errors.

- Payment gateway limitations: Some payment gateways may have specific restrictions or requirements. Familiarize yourself with the terms and conditions of your chosen payment gateway to ensure smooth and consistent payouts.

By understanding how to set up and manage your payout settings in Shopify, as well as troubleshooting common issues, you can ensure a seamless and reliable payment process for your online store.

Remember, consistent cash flow is essential for any business, and Shopify’s payout system is designed to help you maintain financial stability. With the proper setup and ongoing management, you can focus on growing your business while Shopify takes care of your payments.

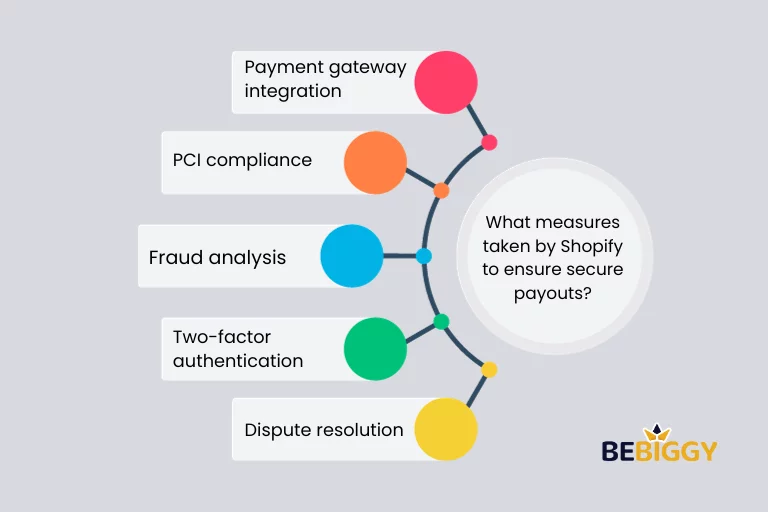

Payout Security and Fraud Prevention

As an e-commerce entrepreneur, you may be wondering how Shopify handles your payouts to ensure security and prevent fraudulent activities. In this article, we will demystify Shopify payouts and provide insights into the measures taken by the platform to ensure secure transactions.

What measures taken by Shopify to ensure secure payouts?

Security is of always vital importance when it comes to handling financial transactions. Shopify takes several precautionary measures to safeguard your payouts from potential fraud. These measures include:

- Payment gateway integration: Shopify integrates with various trusted payment gateways like Stripe, PayPal, and Authorize.Net. These gateways have built-in security features and utilize encryption protocols to protect your customers’ payment information.

- PCI compliance: Shopify is Payment Card Industry Data Security Standard (PCI DSS) compliant. This means that the platform adheres to a strict set of guidelines set by the payment card industry to ensure the secure handling of credit card information.

- Fraud analysis: Shopify employs advanced fraud detection algorithms to analyze transactions and identify any suspicious or fraudulent activities. This analysis helps in preventing unauthorized access to your payouts.

- Two-factor authentication: Shopify offers two-factor authentication for added security. With this feature enabled, any login attempts or changes to your account require a verification code sent to your mobile device, ensuring that only authorized individuals can access your payout information.

- Dispute resolution: In case of payment disputes or chargebacks, Shopify provides a dispute resolution process to help resolve issues between merchants and customers.

Shopify takes several steps to ensure secure payouts and prevent fraudulent activities. From payment gateway integration to two-factor authentication, these measures provide merchants with a safe environment to conduct their e-commerce operations.

International Payouts with Shopify

When it comes to running an online business, one crucial aspect is how you receive your payouts. If you’re using Shopify as your e-commerce platform, you might be wondering how Shopify pays you, especially if you have customers from around the world. Let’s demystify Shopify payouts and understand how it works for international sellers.

What are the Considerations for sellers receiving payouts in different currencies?

If you have customers from different countries, it’s essential to consider how you’ll receive payouts in foreign currencies. Shopify offers multiple payout options, allowing you to receive funds in your local currency. This is incredibly beneficial as it eliminates the need for you to manage currency conversions and associated fees manually.

When you set up your payout settings on Shopify, you can choose to receive funds in the currency that matches your bank account. This simplifies the process and ensures that you receive payouts in your local currency, saving you money on conversion fees and potential losses due to currency fluctuations.

How to manage currency conversions and associated fees?

Shopify also offers an additional feature called Shopify Payments, which allows you to manage currency conversions and associated fees seamlessly. With Shopify Payments, you can choose a primary currency for your store and enable automatic conversion for orders placed in different currencies.

This means that when a customer pays in a currency other than your primary currency, Shopify Payments will automatically convert the payment to your immediate money at a competitive exchange rate. Shopify then deposits the converted amount into your bank account, taking care of all the currency conversion hassles for you. However, it’s important to note that there may be conversion fees associated with this feature.

Shopify offers convenient solutions for international sellers who want to receive payouts in different currencies. By considering these options and utilizing features like Shopify Payments, sellers can streamline their payout process, eliminate manual currency conversions, and focus on growing their online businesses with ease.

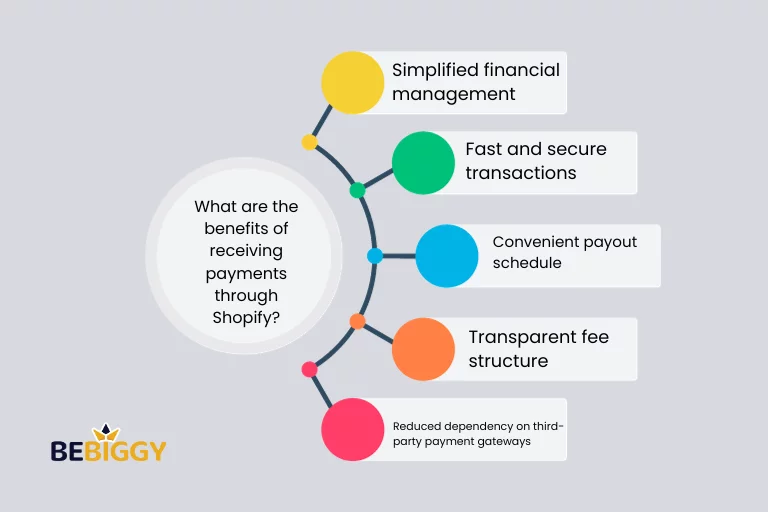

What are the benefits of receiving payments through Shopify Payments?

Receiving payments through Shopify Payouts offers several benefits that can enhance your business operations:

- Simplified financial management: Shopify Payouts consolidates all your payments into one central place, making it easier to track sales, settlements, and refunds.

- Fast and secure transactions: Shopify Payouts ensures that payments are processed securely, protecting both you and your customers from potential fraud or unauthorized transactions.

- Convenient payout schedule: The specific payout schedule may vary depending on your location and bank, but in general, you can expect to receive funds within a few business days after the payout holding time.

- Transparent fee structure: Shopify Payouts provides transparency when it comes to fees, allowing you to quickly understand the cost associated with each transaction and plan your finances accordingly.

- Reduced dependency on third-party payment gateways: By using Shopify Payouts, you can minimize your reliance on third-party payment processors, resulting in a more streamlined payment process and fewer potential points of failure.

Understanding and utilizing Shopify Payouts can significantly benefit your e-commerce business. It simplifies your financial management, ensures secure and fast transactions, and provides a transparent fee structure. By leveraging Shopify’s payment gateway, you can focus more on growing your business while leaving payment processing to a reliable and trusted platform.

FAQS about Shopify Payouts

How does Shopify handle payments?

Shopify provides its payment gateway called Shopify Payments, that allow admin to accept credit card payments directly on your website without needing to set up a separate payment gateway.

When do I get paid?

The timing of your payouts depends on your Shopify plan and the country you’re based in. With the basic Shopify plan, you’ll receive your payouts within two business days. Advanced and Shopify Plus techniques have faster payout options available.

What fees are involved?

Shopify charges transaction fees for all payment providers except Shopify Payments. These charges range from 0.5% to 2%, depending on your plan. In addition, there may be fees from payment processors and third-party apps you use.

How are refunds handled?

When you issue a refund, Shopify will automatically deduct the refund amount from your next payout. If there are not enough funds in your next payout to cover the refund, it will be deducted from future payouts.

How do I get my payout from Shopify?

To receive your payout from Shopify, make sure you’ve set up your preferred payment method within your Shopify account. Once your payment details are in place, payouts will be processed based on your selected schedule, and you can track them in your Shopify dashboard.

Why does my Shopify payout say “paid” but no money?

If your Shopify payout status reads “paid,” but you haven’t received the funds, it’s essential to review your payment details. Ensure the provided information is accurate and that you’ve allowed sufficient time for the transfer. Bank processing times can vary, and it might take a few days for the money to appear in your account.

How long do payouts take from Shopify?

Payouts from Shopify typically take approximately 3 to 5 business days to reach your bank account. The exact duration varies depending on your geographical location and the processing times of your bank.

Does Shopify offer daily payouts?

By default, Shopify doesn’t provide daily payouts. Payout schedules are usually set on a weekly basis or according to your chosen frequency. You can customize the payout schedule within your Shopify account settings to align with your preferences.

What about international payments?

Shopify Payments supports transactions in multiple currencies. This makes it easier to sell to customers worldwide. Conversion fees may apply for currency conversions.

Are there any restrictions on payouts?

Yes, there are some restrictions. For example, high-risk or restricted products may have delayed payouts or additional requirements. Make sure to review Shopify’s terms of service to ensure compliance.

How does Shopify send you your money?

Shopify disburses your earnings through its integrated payment system, which involves processing customer payments and then transferring the accumulated funds to your designated bank account.

How do you get paid out on Shopify?

To receive payouts on Shopify, you must first configure a payment gateway. Following this setup, Shopify will automatically transfer the sales funds from your sales to your bank account according to a regular payout schedule.

Do you get paid right away with Shopify?

Shopify payout payments are processed after some time. The timing of these payouts can vary depending on your chosen payment provider and your location, typically taking a few days to process.

How do I get my money from Shopify to my bank account?

To transfer your earnings from Shopify to your bank account, you’ll need to enter your bank details in the Payment settings of your Shopify account. Once set up, Shopify will carry out the transfers according to the established payout schedule.

Conclusion

Shopify is a transformative e-commerce platform that empowers entrepreneurs and businesses to thrive online with its user-friendly interface and adaptability to industry trends. Understanding Shopify payouts is crucial for managing the financial health of online companies, as it ensures smooth transactions and efficient cash flow management.

Shopify Payments, the primary gateway, offers a straightforward and fee-free process for receiving funds, allowing merchants to customize payout intervals.

This system provides transparent fee structures, secure and fast transactions, and streamlined financial management for e-commerce businesses. By mastering the inner workings of Shopify payouts, entrepreneurs can effectively focus on delivering valuable products and services to a global customer base.

What Is Shopify Dropshipping and How Does It Work?

What Is Shopify Dropshipping and How Does It Work?  Shopify Dropshipping: What You Need to Know Before Buying a Business?

Shopify Dropshipping: What You Need to Know Before Buying a Business?  How to Dropship on Shopify: Step-by-Step Guide

How to Dropship on Shopify: Step-by-Step Guide  How to Make Money with Shopify: Tips and Strategies [100% Profitable]

How to Make Money with Shopify: Tips and Strategies [100% Profitable]